This appendix includes the following topics:

Introduction to LIFO/FIFO Cost Valuation

Distributions to General Ledger

This appendix provides additional information on inventory transaction processing under LIFO, FIFO, or Standard Cost inventory valuation. It should be used in conjunction with the chapter titled Inventory Under Average Cost.

Prior to reading this appendix, read the chapter titled Inventory Under Average Cost. If you are using the LIFO, FIFO or Standard Cost valuation method, do not enter the examples in the chapter. Instead, return to this appendix to enter the examples shown here and to learn about the differences in inventory processing when using the LIFO, FIFO, or Standard Cost valuation methods.

Information specific to entry of fields when using LIFO, FIFO, or Standard Cost valuation methods is presented for each transaction type in Special Notes on Fields.

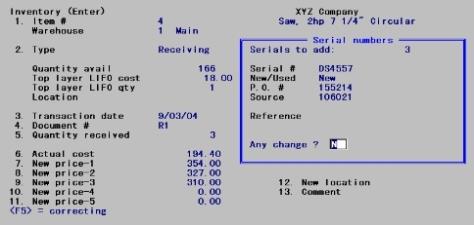

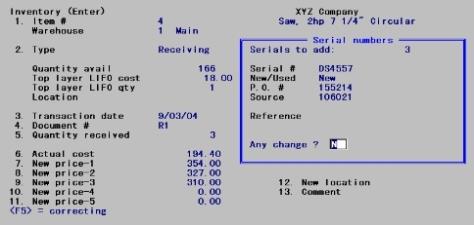

Enter the information shown below for a receiving. The first serial number being received is also shown.

Top layer LIFO cost

With a FIFO inventory, this position displays FIFO cost. The cost displayed is from the top layer in the LIFO/FIFO history. Unposted transactions do not affect the LIFO/FIFO layers until they are actually posted.

The screen above displays (no LIFO layers) because no transactions have been posted yet.

When Standard Cost inventory valuation is used, this position displays the Standard Cost for this item (from Items).

Top layer LIFO qty

With a FIFO inventory, this position displays FIFO quantity. The quantity displayed is the number of units available at the displayed LIFO cost (or FIFO cost). This shows the number of units currently available at that cost as of the last posting.

If LIFO or FIFO layers do not exist, this line shows Replacement cost, instead of the LIFO/FIFO units available.

When Standard Cost inventory valuation is used, this position displays the Average Cost for this item (found in Items).

5. Quantity received

A negative quantity is not allowed under LIFO/FIFO valuation.

|

Format |

99,999,999.99999 |

6. Actual cost

If you are using the Standard Cost method, enter the actual cost and not the Standard Cost. Any variance (difference) between these costs will be reported to you on the Inventory Transaction Register, and the variance will be posted to the purchasing variance account (specified in Control information).

|

Format |

99999999.99999 |

Make changes to the serial number information as usual. The serial fields then clear for entry of the next serial number. Press <Esc> at Serial # when completed entering the serial numbers for the receiving.

|

Example |

Enter serial numbers DS4558 and DS4559 to complete this receiving. Press <F2> at New/Used for each to default the other fields to the same entries as the prior serial number. |

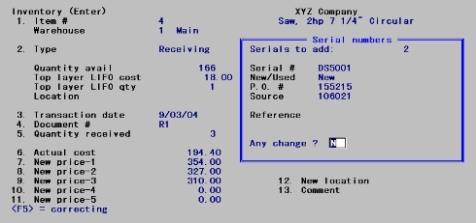

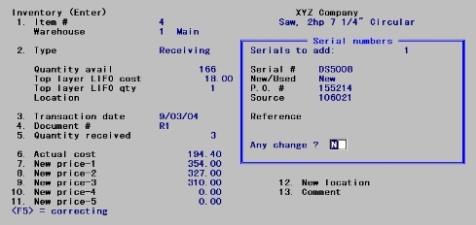

To build up some inventory layers, enter the receivings on the next two screens:

LIFO/FIFO cost histories develop in layers. The receivings you have just entered will create the following LIFO layers.

Inventory, March 16

|

March 16 |

Receivings |

1 Lathe at $194.70 |

|

March 10 |

Receivings |

1 Lathe at $194.10 |

|

March 7 |

Receivings |

3 Lathes at $194.40 |

Because this is the LIFO costing method, the last (most recent) purchase of lathes has become the top layer and will be the first inventory relieved when a sale is made.

|

Example |

Exit the Enter screen, print an Inventory Transaction Edit List, and post the receivings. Return to the Inventory (Enter) selection and this point in the user manual when posting completes. |

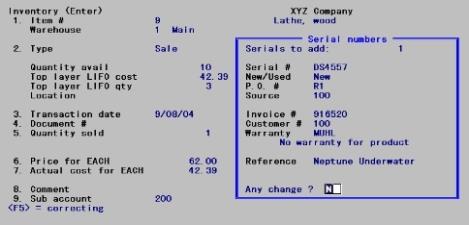

Enter the following sale to further illustrate how LIFO layering works, using the Inventory (Enter) screen.

With a FIFO inventory, this position would display FIFO cost. In either case, the cost displayed is from the top layer in the LIFO/FIFO history, and is the cost as of the last posting. Note that unposted transactions do not affect the LIFO/FIFO layers until they are actually posted.

When Standard Cost inventory valuation is used, this position displays the Standard Cost for this item (from Items).

With a FIFO inventory, this position would display FIFO units. In either case, the number of units displayed is the number of units available at the cost displayed as LIFO cost (or FIFO cost). This shows the number of units still available at that cost from the last posting. (If no LIFO layers have been established, this line shows Replacement cost.)

When Standard Cost inventory valuation is used, this position displays the Average Cost for this item (from Items).

5. Quantity sold

Under LIFO and FIFO, the number of units available in the top LIFO/FIFO layer displays above as part of the old information. If your sale quantity exceeds this amount, you will be using at least one additional LIFO/FIFO layer to satisfy the sale quantity.

|

Format |

99999999.99999 |

7. Actual cost for (stocking unit)

No entry is allowed in this field for sales. Sales are posted at LIFO/FIFO or Standard Cost, depending on the valuation method used.

For LIFO or FIFO, the exact actual cost (per stocking unit) of the sale is determined by relieving LIFO/FIFO layers to satisfy the sale quantity. The total cost, represented by the layers to be relieved, is divided by the sale quantity to obtain the actual cost per unit.

LIFO/FIFO layers are unaffected by unposted transactions. As a result, if you have unposted transactions for the item, the actual cost used when the transactions are posted may be different than the one shown on the screen.

To view the actual cost that will be used during posting, print an edit list.

When a sale is posted, it relieves LIFO/FIFO layers beginning with the top layer and progressing downward. This procedure continues until enough layers have been relieved to satisfy the sale quantity you have entered.

As the layers are relieved, the exact cost of the sale is computed from the costs stored in the layers. In this way, the exact LIFO/FIFO cost is determined.

When the sale is first entered, the actual cost automatically displays on the screen. This cost is obtained from the LIFO/FIFO layers as they exist as of the last posting of transactions.

However, by the time this sale is posted, the LIFO/FIFO layers may have changed due to other transactions that are posted before it.

This occurs because receivings, credit memos, and adjustments are posted first and new layers may have been added. Because of this, the actual cost of the sale may be different than what is displayed on the screen when you were entering the sale.

If you would like to know the exact cost of your sale and how other unposted transactions may affect the cost layers, print an Inventory Transaction Edit List. To see the impact of your transactions on the LIFO layers, post the transactions.

Examine the Inventory Transaction Registers that were printed when you posted the example receivings and sales.

Page 0001 of the first register shows the three receiving layers. The most recent (03/16/15) will be the top layer under LIFO (or the bottom layer under FIFO). If you add down the column under total quantity, you will see that 5 lathes were received.

Page 0001 of the second register shows the sale of 1 lathe. The layer is relieved from the top down. The register shows:

Sale

Layers removed: 03/16/15 each at $194.70 cost

The remaining LIFO layers in inventory would be:

Inventory, March 25

|

March 10 |

Receivings |

1 Lathe at $194.10 |

|

March 7 |

Receivings |

3 Lathes at $194.40 |

The first register shows three receiving layers and a total quantity of 5. The second register shows a sale of 1. Therefore, the remaining inventory is (5 -1= 4 units).

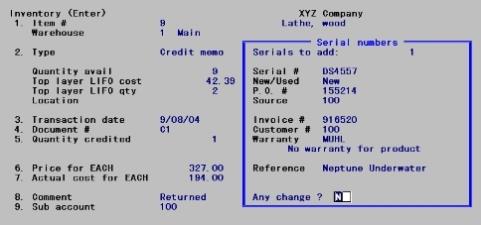

To introduce you to credit memo transactions, assume that the customer to whom you sold the lathe returned it for credit.

Following the same procedure as for sales, enter the information shown below. For Type, specify C (credit memo).

This credit memo creates a new LIFO layer.

An adjustment can also be used to adjust the quantity of a specific LIFO/FIFO layer (specific adjustment). It can also adjust a quantity without regard to a specific LIFO/FIFO layer.

You can see the current LIFO/FIFO layers for any item in inventory by printing a Valuation Report (described in the Valuation Reports chapter).

There are two types of downward adjustments:

| 1. | Specific layer adjustments |

| 2. | Non-specific layer adjustments. |

A specific layer downward adjustment will reduce one layer by the negative quantity you enter. This is useful when you discover that an earlier transaction was entered with a wrong quantity.

A non-specific layer downward adjustment also reduces your inventory by the negative quantity you enter. However, it does so without regard to any specific layer.

This non-specific type of adjustment begins with your top LIFO/FIFO layer, and relieves (eliminates) as many layers as are necessary to satisfy the quantity you entered. As this is done, the cost of the transaction is calculated, using the costs recorded in the layer(s) relieved. For this reason, an entry is not allowed in the Actual cost field when entering a non-specific downward adjustment.

This is useful when you need to adjust inventory as the result of a physical count. In this case, you probably will not know the exact layer(s) affected by your shrinkage, but you are still able to reduce inventory by LIFO/FIFO cost.

There are two types of upward adjustments:

| 1. | Specific layer adjustments |

| 2. | Non-specific layer adjustments. |

A specific upward adjustment increases one layer by the quantity you enter. As with a downward specific adjustment, this gives you the ability to correct an earlier transaction that was entered with an incorrect quantity.

A non-specific upward adjustment also increases your inventory by the quantity you enter. However, it does so by inserting a new layer for the date, quantity and cost of the transaction. If a layer already exists for the entered date and cost, the new transaction quantity is added to it.

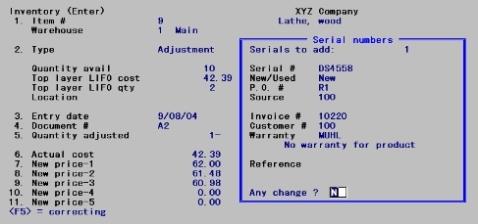

To introduce you to adjustments, enter the information shown below.

| • | When asked if you wish to adjust a specific layer, type Y to assign the adjustment to a specific LIFO inventory layer. (Answering N makes the adjustment without regard to specific layers.) |

| • | Specify “DS4558” as the serial number to be adjusted for this serialized item. |

Note that for a specific layer adjustment, field number 3 changes from Transaction date to Entry date when adjusting a specific layer to Layer date, and field # 6 changes from Actual cost to Layer cost.

Enter the date and actual cost (purchase price) for the specific layer you want to adjust.

The document number used must match the document number used in the transaction that created the layer you are adjusting. In this case, it is R2.

You can get the document number by printing the Valuation Report for this item, selecting to show (LIFO or FIFO) layers.

If the layer date and layer cost do not match an existing LIFO layer, the message LIFO layer not found, press <Enter> or F8 displays.

Only one specific adjustment transaction per a specific layer is allowed for each posting.

If an adjustment brings a layer to zero quantity during posting, that layer is removed. Therefore, you may delete a layer using a specific layer adjustment resulting in a layer quantity of zero.

A specific adjustment cannot cause the resulting quantity of the specific layer to pass through zero. That is, a negative inventory quantity cannot be made positive, and a positive inventory quantity cannot be made negative.

Specified Layer not Found/Invalid Transaction Quantity

While printing an edit list or register, you might get an error message that a specified layer has not been found, or that an invalid quantity was entered. This condition can be brought about by the fact that transactions are posted in date order.

While entering specific layer adjustments, the program automatically checks to ensure that the layer you specified is present and that the quantity entered is acceptable. However, during posting, it is possible that your specified layer may have already been eliminated, or its quantity altered, before your specific layer adjustment is posted.

Your specified layer could be eliminated or have its quantity reduced if you enter a sale or downward adjustment with an earlier date than your specific adjustment. Then posting relieves the layer (the one you had specified for your adjustment) or reduces its quantity in order to satisfy the quantity of the sale. This will happen before the posting process gets to your adjustment.

If adjusting the layer you specified is not possible, one of these two messages will appear on the edit list or register:

Specified layer not found-Entry will not be posted.

Invalid entry qty-Entry will not be posted.

In either case, select Enter and change the specific adjustment so that it applies to a valid layer. Refer to your Valuation Report and Edit List for valid layers.

Attempts to post this transaction will not affect the Running quantity on hand and will not create General Ledger distributions. In effect, this transaction will be automatically deleted during posting. A valid specific layer must be found in order to allow posting to occur for that transaction. Posting for other transactions will continue normally.

Inventory transactions are posted in the order shown below. The G/L distributions generated by posting the transactions are also described here.

Receivings

| • | Debit item’s Inventory Account (Items) |

| • | Credit Balance Sheet Liability Account (I/C Control information) |

If a receiving occurs when there is a negative LIFO/FIFO layer:

| • | Debit item’s Inventory Account (Items) |

| • | Debit (or credit) Cost Correction Account (I/C Control information) |

| • | Credit Balance Sheet Liability Account (I/C Control information) |

For Standard Costing

| • | Debit item’s Inventory Account (Items) |

| • | Debit (or credit) Purchase Variance Account (I/C Control information) |

| • | Credit Balance Sheet Liability Account (I/C Control information) |

| • | See the Special Note on Cost Correction at Cost Correction Notes. |

Kit Assembly

| • | Debit item’s Inventory Account (Items) |

| • | Credit Work in Process Account (entered for the work order) |

If a kit assembly occurs when there is a negative LIFO/FIFO layer:

| • | Debit item’s Inventory Account (Items) |

| • | Debit (or credit) Cost Correction Account (I/C Control information) |

| • | Credit Work in Process Account |

For Standard Costing

| • | Debit item’s Inventory Account (Items) |

| • | Debit (or credit) Purchase Variance Account (I/C Control information) |

| • | Credit Work in Process Account (entered for the work order) |

| • | See the note below titled Special Note on Cost Correction. |

Credit Memos

| • | Debit item’s Inventory Account (Items) |

| • | Credit Memo Account (Items) as the main account number, with the specified profit center (if multiple profit centers are used) |

Upward Job Usages

| • | Debit item’s Inventory Account (Items) |

| • | Credit Job Account (entered for the transaction) |

If a job usage occurs when there is a negative quantity on hand:

| • | Debit item’s Inventory Account (Items) |

| • | Debit (or credit) Cost Correction Account (I/C Control information) |

| • | Credit Job Account (I/C Control information) |

Upward Adjustments

| • | Debit item’s Inventory Account (Items) |

| • | Credit Adjustment Account (entered for the transaction) |

Transfers

No distributions are created for transfers.

Downward Adjustments

| • | Debit Adjustment Account (entered for the transaction) |

| • | Credit item’s Inventory Account (Items) |

Sales

| • | Debit item’s Expense Account (Items) as the main account number, with the specified profit center (if multiple profit centers are used) |

| • | Credit item’s Inventory Account (Items) |

Component Usages

| • | Debit Work in Process Account (this account number is entered when the work order is entered) |

| • | Credit component-item’s Inventory Account (Items) |

Downward Job Usages

| • | Debit Adjustment Account (entered for the transaction) |

| • | Credit item’s Inventory Account (Items) |

Transactions are posted in the same order and with the same amounts as appear on the Inventory Transaction Register.

When there is a negative quantity on hand and a receiving, kit assembly, credit memo, upward job usage, or upward adjustment is posted, if the cost is greater than replacement cost (LIFO/FIFO), then the cost correction account is debited for the difference between the two costs. If the cost is less than replacement cost, then the cost correction account is credited.

For Standard Cost, the Purchase Variance account is debited or credited for differences between the transaction cost and Standard Cost.